Technicall analysis

Technical Analysis Script Overview

This script performs a comprehensive technical analysis on cryptocurrency market data. The script uses various financial indicators, models, and data sources to predict future price movements and provide investment suggestions. Below is a breakdown of the key components and functionality of the code.

Key Libraries and Imports

The script imports a wide range of libraries to handle various aspects of the analysis:

- requests: For making HTTP requests to fetch market data.

- warnings: To filter warnings, specifically for ignoring ConvergenceWarnings from statistical models.

- sys, os: For file system operations and environment variable management.

- Binance API: Access to cryptocurrency market data.

- dotenv: Loads environment variables from a

.envfile. - pandas, numpy: Data manipulation and analysis.

- scipy.stats: Statistical functions.

- ta, sklearn, statsmodels, xgboost: For technical analysis, machine learning, and statistical modeling.

- joblib: For saving and loading machine learning models.

- multiprocessing, concurrent.futures: For parallel processing.

Script Functionality

1. Fetching Historical Data

The get_historical_data function retrieves historical market data (OHLCV) for a given cryptocurrency symbol from Binance.

2. Technical Indicator Calculation

The analyze_data_with_indicators function calculates various technical indicators, such as:

- EMA (Exponential Moving Average)

- MACD (Moving Average Convergence Divergence)

- RSI (Relative Strength Index)

- OBV (On Balance Volume)

- ATR (Average True Range)

- VWAP (Volume Weighted Average Price)

These indicators help in understanding market trends, momentum, and volatility.

3. Fibonacci Levels Calculation

The calculate_fibonacci_levels function computes Fibonacci retracement levels based on historical price data, which are used to identify potential support and resistance levels.

4. Predicting Prices Using Different Models

The script includes three different models for price prediction:

- Linear Regression (

predict_next_price_linear) - ARIMA Model (

predict_next_price_arima) - XGBoost (

predict_next_price_xgboost)

These models are trained on historical price data and are saved for future predictions. If the models already exist, they are loaded and used for prediction.

5. Signal Interpretation

The interpret_signals function analyzes the calculated technical indicators and provides an overall bullish, bearish, or neutral signal.

6. Risk Management Calculations

The script includes functions for managing risk:

- Stop Loss (

calculate_stop_loss): Determines a stop-loss price based on ATR. - Trailing Stop Loss (

calculate_trailing_stop_loss): Adjusts the stop-loss price as the market price moves in favor of the trade. - Maximum Investment (

calculate_max_investment): Calculates the maximum amount to invest based on trading volume and price.

7. Market Sentiment Analysis

The get_fear_and_greed_index function fetches the Fear and Greed Index from an external API to gauge the current market sentiment.

8. Liquidity Analysis

Functions like fetch_market_depth and fetch_bid_ask_spread analyze market liquidity, helping to understand trading costs and market stability.

9. Elliott Wave Confirmation

The script uses Elliott Wave theory to confirm bullish or bearish signals, especially for BTC, which can indicate the overall market trend.

10. Comprehensive Technical Analysis

The technical_analysis function ties everything together, performing a full technical analysis on the given symbol, interval, and historical data. It provides:

- Overall market signal (bullish/bearish/neutral)

- Suggested price targets based on Fibonacci levels and predictions

- Risk management suggestions (stop loss, trailing stop loss)

- Investment recommendations

- Market sentiment and liquidity analysis

Usage

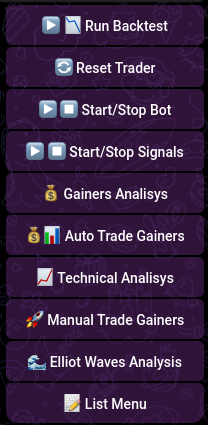

- Select the technicall analysis in the menu option.

- Enter the symbol you want to analyze. If the symbol does not exist on Binance, an exception will be thrown.

- Select the interval: 1h, 4h, or 1d. If the interval is not within this range, an exception will be thrown.